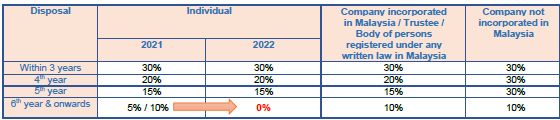

178102022-GST which primarily addresses the taxability of liquidated damages and penalty. Increase in real property gains tax rate.

How To Save Capital Gains Tax On Property Sale 99acres

Husband and wife can each qualify for the one-time exemption.

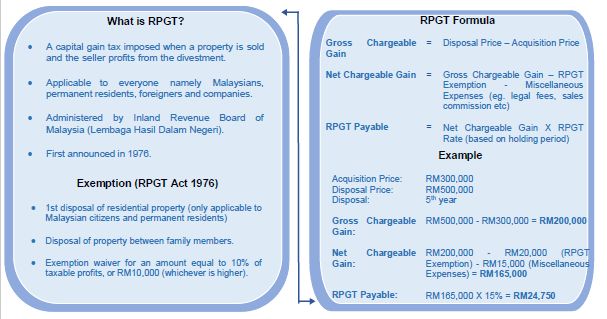

. Real Property Gains Tax Act 1976 Act 169 SECOND SCHEDULE Section 7 CHARGEABLE GAINS AND ALLOWABLE LOSSES ARRANGEMENT OF PARAGRAPHS Paragraph 1. Real Property Gains Tax RPGT Rates RPGT rates differs according to disposer categories and holding period of chargeable asset. The disposer is devided into 3 parts of categories as per Schedule 5 RPGT Act.

Discussion about the FBT exemption that will apply to cars below the luxury car tax threshold for fuel efficient vehicles. PropertyTipProperty speculation occurs when investors speculate to earn huge profits by buying low and selling high making a large return on their investmentPropertyTip. PropertyGuru Tip Property speculation occurs when investors speculate to earn huge profits by buying low and selling high making a large return on their investment.

Property Gains Tax Act 1976 Act 169 Selected Orders As at 15th April 2022 is An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto. Both Acts were introduced to restrict the speculative activity of real estate. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976.

The individual must irrevocably elect for the exemption in writing. Among the measures in PENJANA to stimulate the property market is the exemption from payment of real property gains tax under the Real Property Gains Tax Act 1976 the Act on the disposal by an individual of up to three residential properties from 1 June 2020 to 31 December 2021. The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble.

You cannot use the calculator if you. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974. Paragraph 2 of Schedule 4 of the Act presently provides a formula to determine the chargeable gain where part of a chargeable asset comprising of real property is disposed.

Once you know what your gain on the property is you can calculate if you need to report and pay Capital Gains Tax. 7 November 1975 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan. The Finance Act has amended the RPGT Act to the effect that from 1 January 2019.

This is a once in a life time RPGT exemption. Act 169 REAL PROPERTY GAINS TAX ACT 1976 An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto. Work out if you need to pay.

For individuals citizens and permanent residents real property gains tax at the rate of 5 will be imposed on disposals of chargeable assets notwithstanding that the chargeable assets have been held by Malaysian. On 3 August 2022 the Department of Revenue Ministry of Finance issued its clarificatory Circular No. Real property gains tax act 1976 An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and.

7 November 1975 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan Rakyat in Parliament assembled and by the authority of the. 7 November 1975. This paragraph will be amended under the Bill to introduce the following formula to determine the chargeable gain where part of a chargeable asset comprising of shares in a real property.

RPC is essentially a controlled company where its total tangible assets consists of 75 or more in real property. The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble. Acquisition and disposal gener.

Sections 1 and 2B of TCGA and section 22Aa of CTA 2009 provide that gains accruing on the disposal of UK residential property that has been subject to the Annual Tax on Enveloped Dwellings. CATEGORY OF DISPOSERS UNDER PART II OF SCHEDULE 5 OF THE REAL PROPERTY GAINS TAX ACT 1976 RPGT ACT Part II of Schedule 5 of the RPGT Act specifies the rates of RGPT applicable to companies incorporated in Malaysia trustees or societies registered under the Societies Act 1966. Gains accruing on the disposal of a real property or part thereof occupied or certified fit for occupation as a place of residence.

Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC. Real property is defined as any land situated in Malaysia and any interest option or other right in or over such land. An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto.

Real property gains tax act 1976 An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto. RPGT is charged on chargeable gain from disposal of chargeable asset.

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

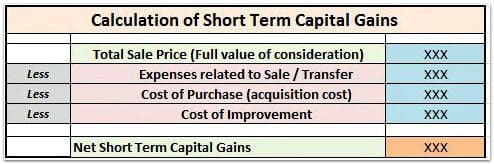

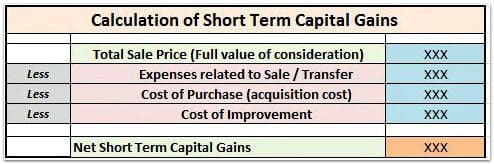

How To Save Capital Gain Tax On Sale Of Residential Property

Real Property Gains Tax Valuation And Property Management Department Portal

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Capital Gains Tax What Is It When Do You Pay It

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Like Kind Exchanges Of Real Property Journal Of Accountancy

Real Property Gains Tax Valuation And Property Management Department Portal

How To Calculate Capital Gains On Sale Of Gifted Property Examples

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How To Save Capital Gain Tax On Sale Of Residential Property

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)